Taxation has been an integral part of human society for thousands of years. From ancient civilizations to modern nations, taxes have played a crucial role in funding government operations and providing public services. In particular, the Roman Empire was known for its complex system of taxation, which helped support its vast military conquests and extensive public works.

The Roman Empire’s tax system was based on a combination of direct and indirect taxes. Direct tariffs was levied on individuals and included the land tax, which was based on the value of a person’s property, and the poll tax, which was a fixed amount paid by each adult male citizen. Indirect, on the other hand, were levied on goods and services and included taxes on imports, exports, and sales.

One of the most important aspects of the Roman tax system was its bureaucracy. The empire employed a large number of tax collectors and administrators who were responsible for collecting and managing taxes. These officials were highly trained and organized, and their work was essential to the functioning of the empire. Despite its complexity, the Roman tax system was generally effective, and it played a key role in the empire’s success and longevity.

Origins of Taxation

Taxation has been a part of human society for thousands of years. The concept of taxation can be traced back to the earliest civilizations. The earliest tax systems were based on the concept of tribute. Tributes were payments made by conquered peoples to their conquerors. Tributes could be in the form of goods, services, or even people. The purpose of tribute was to provide the conquerors with resources that they could use to maintain their power.

In ancient Egypt, taxes were collected in the form of goods. Farmers were required to give a portion of their crops to the pharaoh. The pharaoh used these crops to feed his army and the people of Egypt.

The Romans were known for their advanced tax system. The Roman tax system was based on the census. Every five years, a census was taken to determine the population of the Roman Empire. The census was used to determine how much each person should pay in taxes. The Romans had a variety of taxes, including a tax on land, a tax on goods, and a tax on inheritances. The tax on land was based on the value of the land, while the tax on goods was based on the type of goods being sold.

Taxes in the Roman Empire

The Roman Empire was one of the most powerful and influential civilizations in the ancient world. Taxes played a crucial role in the functioning of the Roman Empire, as they helped finance the vast military conquests and public works projects that sustained the empire’s power and prosperity. The Roman government employed a variety of methods to collect taxes from its citizens.

One of the most common methods was the use of tax farmers, who were private individuals or companies that bid on the right to collect that money in a particular region. Tax farmers were responsible for collecting a predetermined amount of money from the citizens of their assigned region and then remitting that money to the government.

Another common method of tax collection was the use of tax assessors, who were government officials responsible for assessing the value of property and determining the amount of taxes owed by each citizen. Tax assessors were often accompanied by soldiers, who ensured that citizens paid their obligations in full.

The Roman government set a wide variety of taxes on its citizens, including income, property, sales, and import/export taxes.

- Income taxes were levied on all citizens and were based on a percentage of their annual income.

- Property taxes were based on the value of a citizen’s land, buildings, and other possessions.

- Sales taxes were levied on goods sold within the empire

- Import/export taxes were levied on goods imported into or exported from the empire.

These taxes were often used to regulate trade and protect domestic industries.

The Roman tax system had a significant impact on the economy of the empire. While taxes helped finance the empire’s military and public works projects, they also placed a heavy burden on the citizens of Rome. High taxes often led to economic hardship and social unrest, as citizens struggled to make ends meet. Despite these challenges, the Roman tax system played a crucial role in the functioning of the empire. By providing a steady source of revenue, taxes helped ensure the stability and longevity of the Roman Empire.

Evolution of Taxation

Taxation has been an essential part of human society since ancient times. The concept of taxation has evolved over time from simple forms of tribute to complex systems of taxation. During the Middle Ages, taxes were levied by feudal lords and monarchs. These taxes were often arbitrary and oppressive, and the burden of taxation fell mainly on the poor. The church also levied taxes, known as tithes, which were a percentage of a person’s income or produce.

In England, the first modern tax system was introduced in the 12th century, known as the “Danegeld.” This tax was levied to pay tribute to the Danes in exchange for peace. Later, in the 13th century, King Henry III introduced the “Aid,” which was a tax levied to finance the king’s military campaigns.

In the modern era, taxation has become more complex and sophisticated. The concept of progressive taxation, where the wealthy pay a higher percentage of their income in taxes, was first introduced in the United States in the early 20th century. Today, most modern tax systems are based on the principles of progressive taxation.

Governments also use taxation as a tool to achieve social and economic goals. For example, taxes on tobacco and alcohol are used to discourage consumption, while taxes on luxury goods are used to redistribute wealth. In recent years, there has been a growing trend towards environmental taxation, where taxes are levied on activities that harm the environment, such as carbon emissions. Taxation has evolved significantly over time, from simple forms of tribute to complex systems of taxation. Today, taxation is an essential part of modern society, and governments use it to achieve a wide range of social and economic goals.

Tax Administration in History

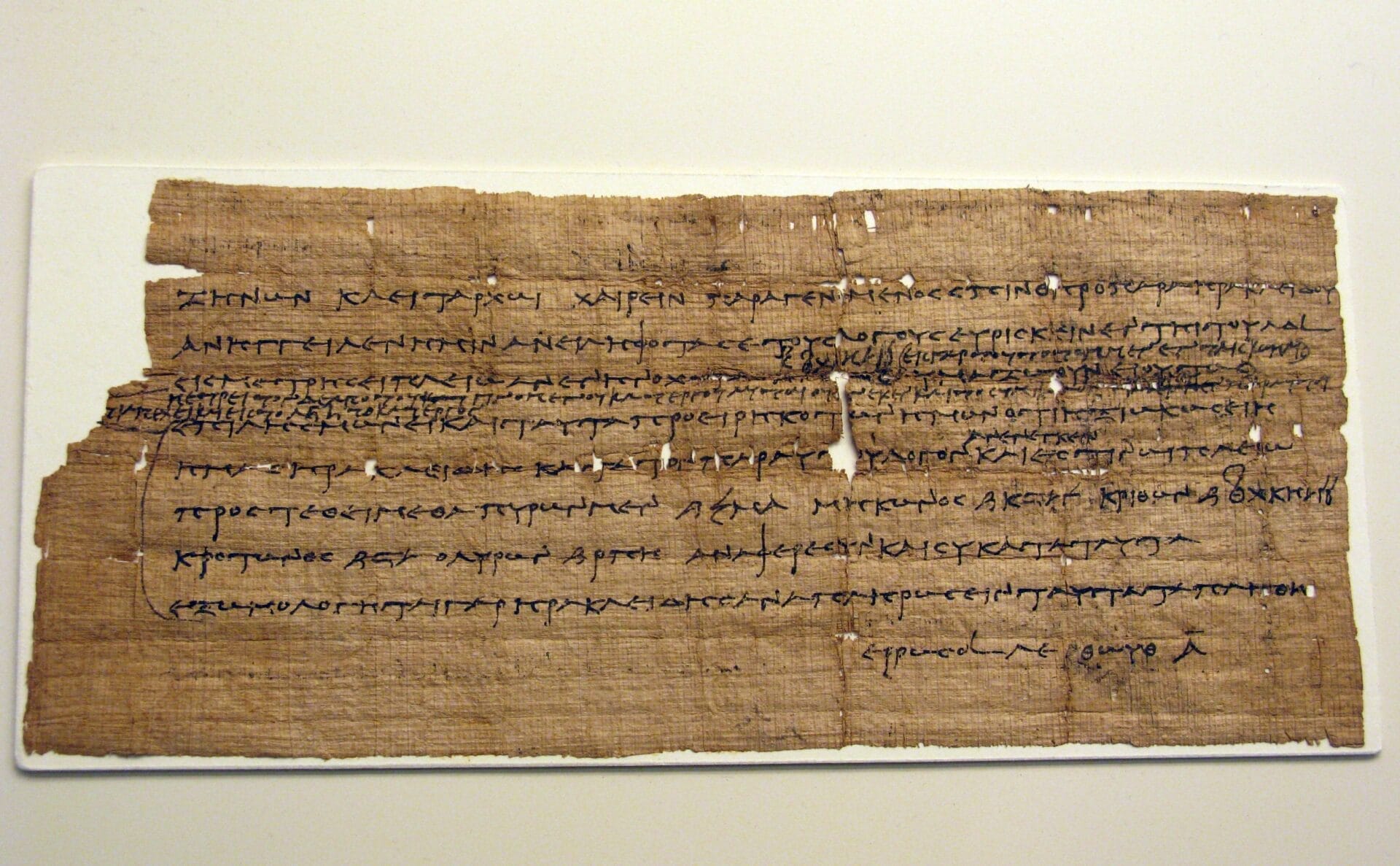

Taxation has been around for thousands of years, and it was an essential part of the Roman Empire’s economy. The Roman Empire was one of the first civilizations to implement a formal tax system, and it was a vital source of revenue for the state. Tax collectors were responsible for collecting taxes from citizens, and they had to keep detailed records of the amounts collected. The Roman Empire had a sophisticated system of record-keeping that allowed tax collectors to keep track of who had paid their taxes and who had not. This system was essential for enforcing tax laws, and it made it easier for the state to collect taxes from its citizens.

Tax collectors played a crucial role in the administration of taxes in the Roman Empire. They were responsible for collecting taxes from citizens and ensuring that all taxes were paid on time. Tax collectors had to be knowledgeable about the tax laws and regulations, and they had to be able to communicate effectively with citizens. Tax collectors were also responsible for enforcing tax laws. They had the authority to seize property from citizens who had not paid their taxes, and they could also impose fines and penalties on those who had not paid their taxes on time.

Tax administration has been an essential part of human history, and the Roman Empire was one of the first civilizations to implement a formal tax system. Tax collectors played a crucial role in the administration of taxes, and they had to be knowledgeable about the tax laws and regulations. The sophisticated system of record-keeping in the Roman Empire made it easier for tax collectors to enforce tax laws and collect taxes from citizens.

Cultural Perspectives on Taxes

Public attitudes towards taxes have varied throughout history and across different cultures. In ancient Rome, taxes were seen as a necessary evil to support the empire’s military and civic infrastructure. While some citizens grumbled about the burden of taxes, most accepted them as a fact of life. Today, attitudes towards taxes have become more complex. In some countries, taxes are seen as a way to fund public services and redistribute wealth, while in others, they are viewed as an unfair burden on hardworking citizens.

Besides the general acceptance of taxes in ancient Rome, there were still those who sought to evade or resist them. Tax collectors were often viewed with suspicion and even hostility, and some citizens went to great lengths to avoid paying their dues. Today, tax evasion and resistance remain significant issues in many parts of the world. Some individuals and businesses engage in illegal activities to avoid paying taxes, while others use legal loopholes to minimize their tax burden. In some cases, tax resistance takes the form of protests or civil disobedience.

Overall, cultural attitudes towards taxes have evolved over time, reflecting changes in political and economic systems as well as shifts in public opinion. While taxes are still a contentious issue in many parts of the world, they remain a crucial source of revenue for governments and a necessary part of modern society.

Comparative Taxation

When it comes to taxation, the Roman Empire was not the only civilization to implement a tax system. In fact, many other empires had their own unique methods of taxation. For example, the Chinese Han Dynasty implemented a tax system that was based on the amount of land owned by individuals. The Aztec Empire also had a tax system that was based on the amount of land owned as well as the number of people in a household.

The Persian Empire had a tax system that was based on the production of goods, while the Ottoman Empire had a tax system that was based on the collection of tribute from conquered territories. These different tax systems highlight the diversity of approaches that empires took to taxation.

The Roman tax model has been particularly influential. The Roman Empire was able to maintain a vast and complex empire in large part due to its sophisticated tax system. The Roman tax system was based on a census of the population, which was used to determine the amount of taxes that individuals and communities were required to pay.

One key lesson from the Roman tax model is the importance of accurate record-keeping. The Roman census was conducted every five years, and it was a massive undertaking that required a great deal of resources. However, the accuracy of the census allowed the Roman Empire to effectively collect taxes and maintain social order.

Another lesson from the Roman tax model is the importance of fairness. The Roman tax system was designed to be proportional, meaning that individuals and communities were required to pay taxes based on their ability to pay. This approach helped to ensure that the burden of taxation was distributed fairly across the population.

Legacy of Roman Taxation

The Roman Empire had a significant impact on the development of taxation systems across the world. The Romans were known for their efficient and organized tax collection system, which helped fund their vast empire. The legacy of Roman taxation can still be seen in contemporary tax laws.

In addition, the Romans were known for their use of tax incentives and penalties to encourage compliance. This practice has been adopted by many modern governments, who use tax breaks and penalties to encourage certain behaviors and discourage others. The Romans also used tax revenue to fund public works, such as roads, aqueducts, and public buildings. This practice has been continued in modern times, with many governments using tax revenue to fund infrastructure projects and other public works.

Overall, the legacy of Roman taxation can be seen in the many modern tax laws and practices that have been influenced by their efficient and organized tax collection system.

People Also Ask:

When did taxation start in Rome?

Ancient Roman Emperor Augustus changed the tax system in the late 1st century BCE. The collection had originally been done through “tax farmers” who collected taxes from their respective regions based on the assessment of the region as a whole and turned them over to the government.

What were the taxes in the Roman Empire?

Ancient Roman tax systems were regressive – they applied a heavier tax burden on lower income levels and reduced taxation on wealthier social classes. In ancient Rome, taxation was primarily levied upon the provincial population who lived outside of Italy.

How taxation was practiced in the early stage of history in the Roman Empire?

Early Roman forms of taxation included consumption taxes, customs duties, and certain “direct” taxes. The principal of these was the tributum, paid by citizens and usually levied as a head tax; later, when additional revenue was required, the base of this tax was extended to real estate holdings.

What is the oldest income tax?

In order to help pay for its war effort in the American Civil War, the United States government imposed its first personal income tax, on August 5, 1861, as part of the Revenue Act of 1861. Tax rates were 3% on income exceeding $600 and less than $10,000, and 5% on income exceeding $10,000.

Did Rome fall because of taxes?

As Rome lost territory, it also lost its revenue base. Rome’s wealth was originally in the land, but this gave way to wealth through taxation. During the expansion of Rome around the Mediterranean, tax farming went hand-in-hand with the provincial government since the provinces were taxed even when Romans proper were not.

Hello, my name is Vladimir, and I am a part of the Roman-empire writing team.

I am a historian, and history is an integral part of my life.

To be honest, while I was in school, I didn’t like history so how did I end up studying it? Well, for that, I have to thank history-based strategy PC games. Thank you so much, Europa Universalis IV, and thank you, Medieval Total War.

Since games made me fall in love with history, I completed bachelor studies at Filozofski Fakultet Niš, a part of the University of Niš. My bachelor’s thesis was about Julis Caesar. Soon, I completed my master’s studies at the same university.

For years now, I have been working as a teacher in a local elementary school, but my passion for writing isn’t fulfilled, so I decided to pursue that ambition online. There were a few gigs, but most of them were not history-related.

Then I stumbled upon roman-empire.com, and now I am a part of something bigger. No, I am not a part of the ancient Roman Empire but of a creative writing team where I have the freedom to write about whatever I want. Yes, even about Star Wars. Stay tuned for that.

Anyway, I am better at writing about Rome than writing about me. But if you would like to contact me for any reason, you can do it at contact@roman-empire.net. Except for negative reviews, of course. 😀

Kind regards,

Vladimir